Advantages of Preparing Cash Budget

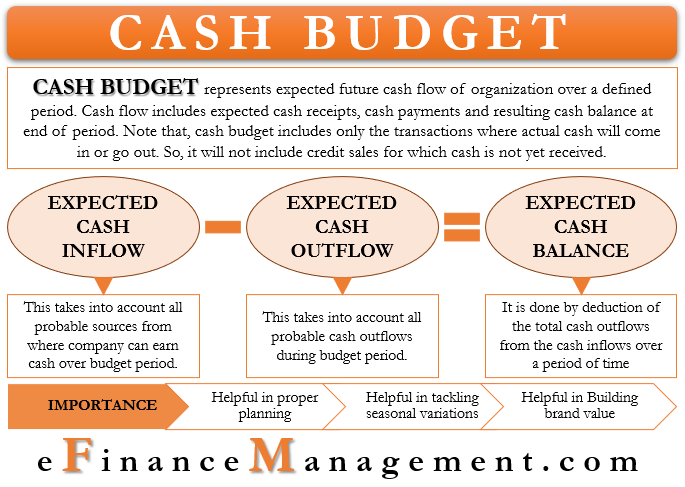

It is a traditional method. It reflects expected receipts and payments of cash under different heads during the budget period.

Flexible Budget Meaning Advantages Disadvantages Preparation And More Budgeting Bookkeeping And Accounting Budget Meaning

Each night at closing balance the cash drawer back to the starting amount.

. Into every life a few budget variancesdifferences between actual spend and the amount budgetedmust fallHuman error changing market conditions new customers and even. Before preparing your first organizational budget its important to understand what goes into a budget and the key steps involved in creating one. Cash Inflow Forecast.

But as most financial pros know making a budget and sticking to it are two very different things. Preparing any type of business budget. It documents anticipated payables and receivables for an upcoming period.

For example if you calculate cash flow for 2019 make sure you use. Furthermore every time you sit down to enter your costs into your budget you are effectively re-committing to your objectives. Budget Management Financial Reporting.

These sources include cash sales cash to be received against accounts receivables cash to be generated from the sale of a fixed asset over the period cash to be earned from the sale of stocks and bonds or any other. Standard costing is a system of accounting that uses predetermined standard costs for direct material direct labor and factory overheads. Flexible Budget Vs Static Budget.

Impact and Challenges of Order to Cash Management. The availability of cash may be a matter of life or death. People rely on him for investment-related tips and advice budgeting skills and personal financial matters.

Provides precise timing of when cash comes in and out of the company. Your business budget acts as a roadmap for your companys finances. Personal finance may also involve paying for a loan or other debt obligations.

This budget takes into account all the probable sources from where the company can earn cash over the budget period. Buying an established business means immediate cash flow. Use your master budget to plan what you need to do to reach business and financial goals.

This might mean you have a new plan with your new employer or that the funds can. The inflows and outflows of cash come from the cash budget. The cash budget is futuristic.

The business will have a financial history which gives you an idea of what to expect and can make it easier to secure loans and attract investors. Often your employer s 401 k doesnt allow them to pay you out with a check if your old 401 k account contains more than 1000. The Advantages of Data-Driven Decision-Making.

It is simply a cash flow prepared in advance. Discover what businesses still use these systems their advantages and disadvantages and the definitions of single-entry and double-entry types of manual accounting. There are several advantages and disadvantages in preparing a budget on a cash basis.

Pros and Cons of a Cash Budget. Cash flow from investment activities are caused by payments made into investment vehicles loans made to other entities or the purchase of fixed assets. The business should have plans and procedures in place.

4 Collection of Cash. Your master budget may consist of a number of different budgets including. If possible two people should be involved in counting the cash drawers and preparing the deposit in order to minimize errors or.

Estimation of cash collection is also a part of this budget as there are different types of customers in the business where some pay in cash while others choose the option of credit purchase. The amount of cash over the starting amount is your daily deposit and should be prepared according to your operating procedures. This excludes cash and cash equivalents and non-cash accounts such as accumulated depreciation and accumulated amortization.

Cash Budget Cash Flow Statement. Best Budget Planners Check Them out Here. The difficult start-up work has already been done.

How better management in AP can give you better flexibility for cash flow management. The cash flow statement is a post-mortem analysis revealing inflows and outflows of cash having taken place during a past period. Building a budget is a standard part of doing business for organizations of all sizes and types.

He is involved in preparing an annual operating budget monthly financial reports and analysis and maintenance of up-to-date general ledger. Personal finance is defined as the mindful planning of monetary spending and saving while also considering the possibility of future risk. Cash outflows related to fixed asset purchases can spike shortly after the start of a new fiscal year right after the annual capital budget has been approved.

Companies use financial budgeting to facilitate planning and control within a business firm so that they can manage the financial aspects of their business and plan for new product expansion in the future. The cash budget template is for educational purposes only and should not be relied upon without professional advice. As such the result of the financial budget is the budgeted balance sheet.

The standard costing technique is. Personal finance may involve paying for education financing durable goods such as real estate and cars buying insurance investing and saving for retirement. Advantages of Cash Management.

If the account has between 1000 to 5000 the Internal Revenue Service generally requires that the company roll your funds to a new IRA account. 10152021 Create an. Here are some key pros and cons.

1 Incremental Budgeting. We would like to show you a description here but the site wont allow us. The above benefit areas are clear that the main aim of preparing cash budget is to predict the cash flows over a given period of time and to determine whether at any point of time there is likely to be a surplus or deficit of cash.

And speaking from personal experience the more you talk about your goals and evaluate your progress the more likely you are to reach them. Different methods of preparing financial plans are as follows. For example consider a business that regularly experiences year-over-year revenue growth thats.

12 Advantages of Outsourced. 12 min read Read more. The manager takes the previous periods budget as a benchmark.

So the management should estimate using the past recovery trend the expected amount to be recovered in the coming period. Standard costing is the second cost control technique the first being budgetary controlIt is also one of the most recently developed refinements of cost accounting. Pros and Cons.

Download our guide Preparing Your AP Department For The Future.

Advantages And Disadvantages Of Budget What Is Budget Advantages And Limitations Of Budget A Plus Topper

Cash Budget Meaning Preparation Example Importance

15 Cash Budget Advantages And Disadvantages Brandongaille Com

Advantages And Disadvantages Of Budget What Is Budget Advantages And Limitations Of Budget A Plus Topper

Comments

Post a Comment